IRS LT11 Notice: What You Should Do When You Receive ...

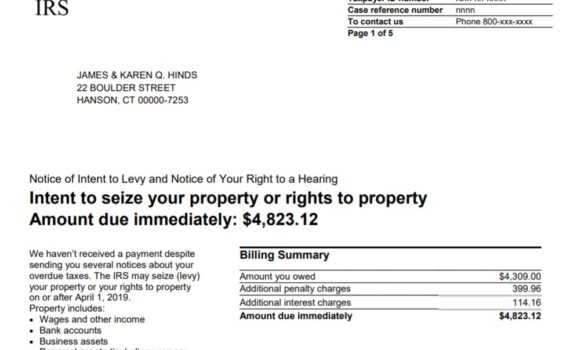

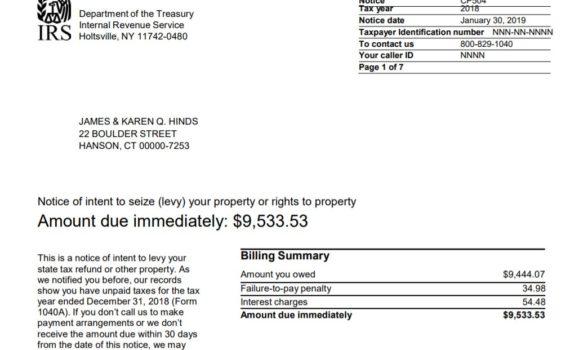

Getting an LT11 notice means that the IRS intends to levy your property or rights to property. It […]

Getting an LT11 notice means that the IRS intends to levy your property or rights to property. It […]

A part of the IRS duty is to remind taxpayers if they have any outstanding taxes. They send […]

If you are a low income individual who is currently facing issues with the IRS, you can seek […]

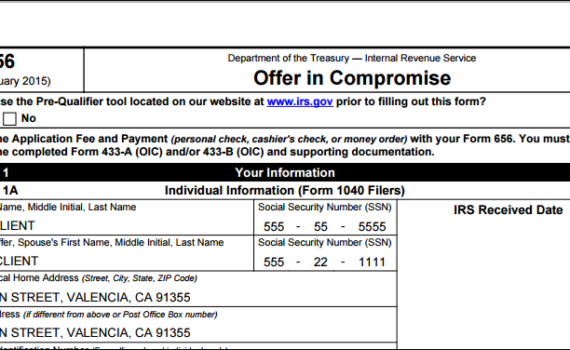

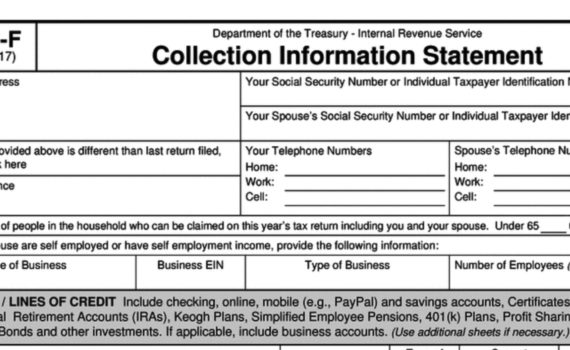

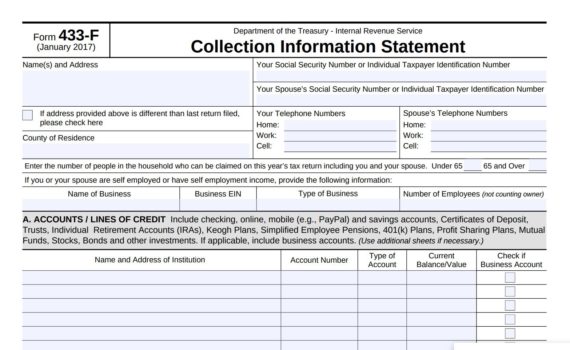

If you want to know how you can file for an Offer In Compromise, below you will learn […]

One of the programs that the IRS offers to those who cannot pay their tax debt is through […]

Tax relief is a category that encompasses many options. Here we go through and explain the various options […]

Currently Not Collectible status is one of the most popular options for tax relief cases. It is considered […]

Where your collections case is handled depends on the balance and tax type. The IRS collections process can […]

When it comes to settling back taxes, many taxpayers find an answer by hiring a tax attorney. But […]