This guide does not constitute legal advice and proceeds at your own risk. Consult with a licensed tax attorney if you are unsure about anything. See our video explanation below and keep reading for a more in-depth guide to tax relief.

UPDATE 5/20/2021: IRS payment plans are now easier for large balances and updates are reflected below.

Selecting The Best Tax Relief Option

Tax relief first should be divided into two categories: tax debts that are final and tax debts that are still in dispute. Debts that are final would be those where the amount is not in dispute, meaning there is no audit or pending change of the tax return ongoing. Debts that are not final would be those that are still in audit or under some other type of review. Finalized tax debt tax relief options are what most people are looking for, but we will cover both here in this post.

Keep reading to get tax relief.

You can also have someone do it for you. Tax attorneys are recommended over tax relief companies since they won’t close on you. You may also be interested in our posts related to this topic: how to prevent and release IRS garnishment.

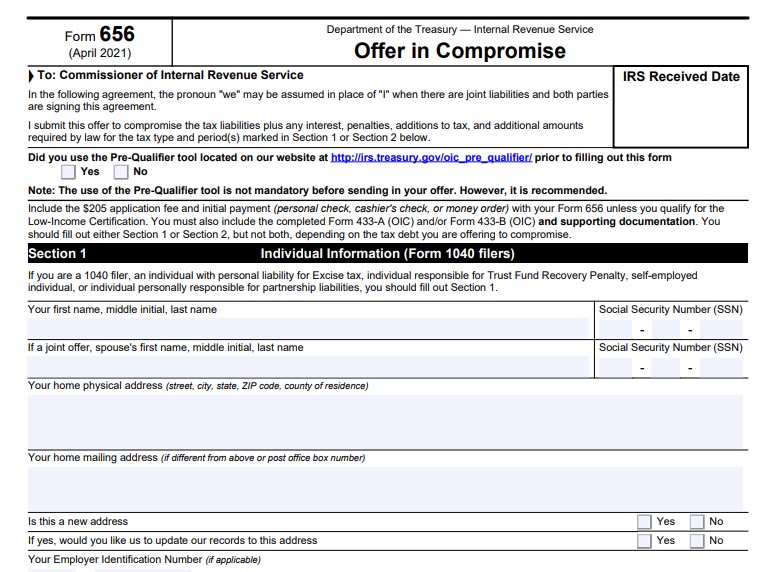

Tax Relief for Finalized Debts: Offer In Compromise is the best option

When the debt is not in dispute, there are the following tax relief options:

- Offer In Compromise

- Currently Not Collectible

- Payment Plan

- Pay in Full

Offer In Compromise is the best option for those that qualify, and we will go through the basics of qualification for that first, then proceed to the other tax relief options.

Offer In Compromise works when assets and income are low compared to the debt total

The first thing to look at is assets. If you have more assets than the tax debt, your chances are not that good. There are exceptions and we have had Offers approved when a client had a very low-value home, when a property could not be sold after being listed, and when the property was needed to make income.

Second, income is taken into consideration. Your income must barely cover or not cover your expenses unless you have an extremely large debt. If you are single making $100,000 annually and you owe $50,000, you most likely are not getting an Offer In Compromise approved. If you owe $1,000,000 there is a good chance of acceptance, but it will be a large settlement amount

More dependents increase the chance of Offer acceptance. The IRS uses figures based on how many dependents are living in your household. The more the better when it comes to your odds at getting an Offer In Compromise.

Dissipated assets can ruin your Offer

If you cashed out a 401K or sold something significant in the last 3 years and did not pay taxes on it, the IRS will treat it as a dissipated asset. This means they calculate it into your settlement whether or not you actually have the funds. They think since you had the money in hand, you should have paid then.

Example: Sold off all stocks and cashed in $150,000. IRS debt is $50,000 and it has only been one year. The IRS won’t accept an Offer In Compromise in most cases.

If you feel that you are barely or not covering expenses and you have a lower than average income for your area, there’s a very good chance you will get an Offer In Compromise accepted. See our complete Offer In Compromise guide for more information if you think you qualify. It is updated yearly with the latest forms.

Old tax debts sometimes should be handled differently

If you have old tax debts, see our tax debt expiration guide for more information before proceeding on an Offer. You may choose to go with Currently Not Collectible as explained below.

We can also do it for you, but we don’t recommend waiting to hire someone if you cannot afford it. Just get it in. Many people call us when they finally get a higher-paying job and then they don’t qualify. If your Offer is not perfect the IRS will just ask for additional info. We can review your Offer as well as a lower-cost option.

Currently Not Collectible Status: Tax Relief When You Got Assets or Old Debts

This tax relief option is often recommended by IRS agents who fail to mention Offer In Compromise. It’s effectively a payment plan for $0. The debt is still owed, but at some point, it will expire. Sometimes a case can be put into this status and no payments will be made until it expires, effectively creating a lower payment than an Offer In Compromise.

Currently Not Collectible is the best tax relief option if you have assets, but low income or if you have old tax debts that are going to expire soon. Filing for Currently Not Collectible status and having a tax debt of over $10,000 will result in a Federal tax lien. The lien does not necessarily mean anything will get taken away, it just secures their interest. We’ll go through both scenarios.

Too Many Assets For An Offer In Compromise or Dissipated Assets

If you have more assets than the tax debt you probably are not getting an Offer. The same applies if you have dissipated assets as explained above. However, often you can submit for Currently Not Collectible and get approved without having to sell off anything. After computing your income and expenses, if your available income is determined to be $50 or less per month, you probably will get approved.

We have seen the IRS request people to pay out what is in their bank account or retirement account, but not always. We recommend mailing in the request if you have a 401K. It seems when mailed in they are less likely to ask you to cash it out.

Example: Own a home that is paid off of high value, but per month barely making expenses. Currently Not Collectible is probably the best tax relief option.

Tax Debts Expiring Soon

IRS debts have an expiration date. Things can extend that date as well. If your debt is set to expire soon, submitting an Offer In Compromise will extend the amount of time the IRS has to collect. Currently Not Collectible does not extend the statute except for the brief period where the IRS is processing your request as long as your request is based on the information you submitted.

If your account was placed in Currently Not Collectible because you were out of the country and did not submit financial information, the debt expiration period may get extended. The downside of Currently Not Collectible is that after the debts expire, tax liens will get released but not withdrawn. However, having a released lie

Example: You $100,000 for 2009 and it expires in May of 2020. It currently is May 2019. It might be better to just get Currently Not Collectible and let the debt expire.

See our guide on Currently Not Collectible for information on how to proceed with this tax relief option.

Payment Plans: Tax Relief Made Simple

Doesn’t qualify for an Offer or Currently Not Collectible seem unattainable?

Then a payment plan is an easy option. If you can’t or do not want to pay it in full, you can put your balance into an IRS payment plan. It is tax relief in the fact that it will stop garnishments and bank levies from occurring and also release any existing garnishments. The three categories of IRS payment plans:

- Paid over 72 months for balances under $50,000

- Paid over 84 months for balances between $50,000-$100,00

- Payment plans where you owe over $100,000 and other payment plans that require the submission of a financial statement because you cannot afford the payments on the 84 months or 72-month payment plan

The type of payment plan you get is based on how much you owe and whether or not you can make a minimum payment that the IRS is requesting. If you cannot make the minimum payment that they are requesting, then a financial statement will be required.

Payment plans for balance under $50,000

When you owe less than $50,000 but otherwise don’t qualify for a Currently Not Collectible or an Offer in Compromise, you may just want to request an easy payment plan over 72 months as long as you pay it off over 72 months. The IRS does not require a financial statement. They will go ahead and they do not issue any liens on top of that you can request the penalty abatement at the appropriate time.

An easy payment plan with the IRS

Payment plans between $50,000 and $100,000

The balance can be spread out over 84 months. The IRS will not request a financial statement from you. However, the IRS will file a lien at this balance amount. The only way to avoid a lien in this situation is to pay the balance below $50,000 and then put it in the 72-month payment plan as we explained above. You can also request a penalty abatement once you come close to paying off the first year you owe.

Payment plans under $250,000

As a part of the IRS Fresh Start program, the IRS now accepts any payment plan that pays the taxes off before the tax debt expires (also known as the Collection Statute Expiration Date). Tax liens will still be filed under this payment plan scenario as long as the balance is over $50,000.

Payment plans over $250,000

When you over $250,000 unless you can pay it down below $250,000, the IRS is going to require a financial statement. The amount you pay per month will be based on the data on the financial statement. There are some cases where Currently Not Collectible doesn’t end up happening and someone cannot afford the Offer in Compromise number, so they often end up in payment plans that do not pay off the balance in full because the balance expires before the debt is paid in full. In a way, it is almost like a reverse Offer in Compromise.

When you owe more than $250,000, you’re not going to easily get an Offer in Compromise or Currently Not Collectible status unless your financials are simple. Attorneys are strongly recommended to handle these kinds of cases. In this type of payment plan, you can also request a penalty abatement.

Submitting a financial statement

When you don’t qualify for an Offer in compromise or Not Collectible yet you still cannot make the minimum monthly payment that the IRS is requesting for the 72 or 84 month plan, then you need to submit a financial statement. We have found that in most cases like this we can usually find some way to get the client an Offer in Compromise. A lot of times there is an expense that is not considered or there was an expense that the client can add that is valid that would make them qualify for an Offer in Compromise.

If you find yourself in this category, definitely give us a call so we can go over your case and see if we can make an Offer In Compromise happen for you, in a legal way of course. These type of payment plans often do end up being similar to Offer in Compromise because the tax may expire before you finish paying it off.

Resolving IRS debt with a payment plan

See our in-depth guide on IRS payment plans for more information if you are taking this route of tax relief.

Paying the IRS in full: Often best if you can do it

If you have money sitting there, might as well pay it off. You will not get an Offer In Compromise and the payment plan will just add penalties and interest. Some may have something else the money is going to or an investment that will make them more than the IRS penalties and interest rate. In that case, you still might go with a payment plan.

Penalty Abatements: For payment plans and full payers

Those paying in full or in a payment plan will want to request a penalty abatement. It’s easy to get on the first year that you owe on if the prior 3 years do not have a previous penalty on the account. The IRS will grant a “first-time penalty abatement” based on prior compliance. For any other year, you have to show “reasonable cause” according to the IRS.

We inform clients that “reasonable cause” can be hard to prove and don’t count on getting out of penalties for the other years if you are doing a full payment or payment plan.

See our first-time penalty abatement guide for more information.

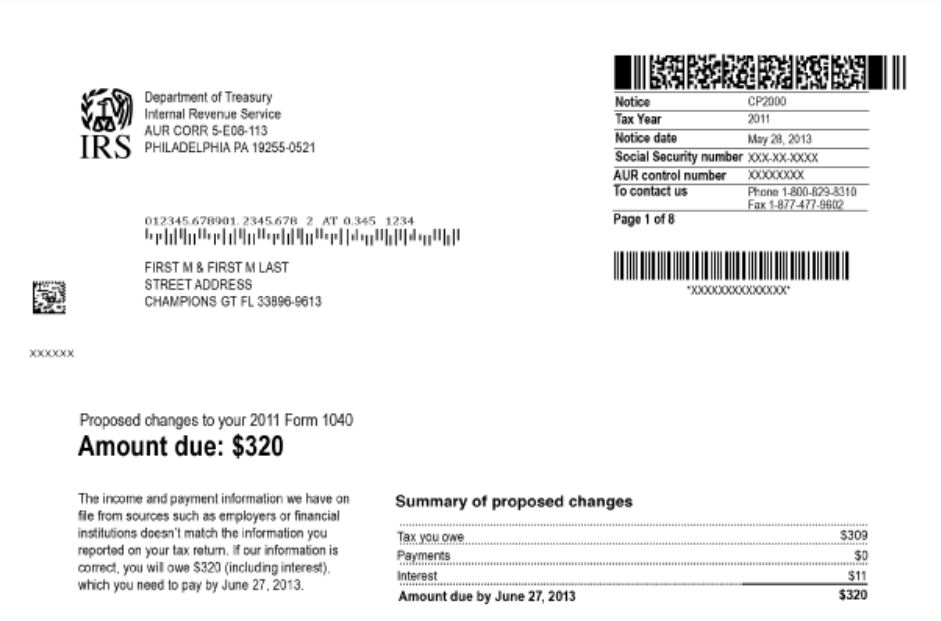

Tax Relief For Debts That Are not Finalized or Wrong

Some tax debts may not be completely finalize

These tax debts might be under audit or you may have received a CP2000 notice requesting information or adding tax debt to your balance. These are not yet finalized because you either have not signed off in approval of the change, or IRS has not entered the change by default due to your lack of correspondence.

You may also be in the middle of an auditor in the mix of responses with the IRS and these debts might not be finalized. The tax relief goal in these cases is to lower the debt as much as possible before it becomes final.

You receive a CP2000 when the information you reported on your tax return does not match records that were sent to the IRS from another source

Audit reconsideration is a request to the IRS to reconsider their previous determination. Sometimes you may not have received the audit paperwork or at the time you did not have the documentation. Although it is not a right to have a reconsideration, the IRS does not want to stick you with the debt you really do not know so if you can prove it with proper documentation it’s very likely they will approve a reconsideration.

What you can do in an audit, CP2000 notice, or reconsideration to get tax relief

For an open audit or CP2000, you need to provide all the information the IRS is requesting. As long as your information is properly documented and you can show proof of expenses, it’s very likely there will be no change to the audit. If everything is not documented properly and it’s hard to put everything together you probably want to call a tax attorney to help you with the audit.

If an audit has already taken place or CP2000 notice was already closed out but you think everything was wrong you may want to do an audit reconsideration. However, you must have good documentation to prove that you really do not owe the debt. If you don’t have proper documentation and a good explanation, it might not be worth your time.

When the audit reconsideration won’t wipe out the debt anyway

If you were audited or had a CP2000 notice that added a significant balance and doing an audit reconsideration would only slightly reduce the balance, you may want to look if you qualify for an Offer in Compromise first. If you’re going to get an Offer in Compromise anyway, it might not be worth the headache to go through an audit reconsideration if it’s really not going to wipe out the balance. The truth is, an Offer in Compromise will wipe out the debt completely and it’s based on your financial information. So if you qualify, it’s easier to go with the Offer first.

Example: You have a tax debt of $100,000. If you win your audit reconsideration you would have a tax of $50,000. You already qualify for an Offer In Compromise for $100. There is no point to submit the audit reconsideration. If you get the Offer in Compromise, it wipes out the entire debt and is based on your financial information, not the balance total.

Concluding our guide on Tax Relief

Tax relief is a complex subject. If you pick the right resolution and follow through with the paperwork, you should see some results. If you do have a complex case, doing it yourself might be a headache. You might be better off just hiring a tax attorney. However, if you’re not in a financial situation to hire help, we recommend you to go proceed with a resolution.

You often will get the best resolution when you’re making the least amount of money. The more money you make the less likely you are to get an Offer in Compromise. The less money you have, the more likely you are to get away with paying the IRS less.

Getting help is easy

At the same time, many tax relief services are more affordable than you may think. Our firm’s fees are very affordable and we only charge you for the time that we spend in your case. You won’t be charged a percentage of how much is owed. We only charge you the time it takes to get you the best result possible. If we can get you a settlement will let you know quickly and if not, we’re not here to waste your time or money.

That being said, if you are struggling financially and think you qualify for an Offer, just get it in ASAP and use our tax help guide to walk you through the process.

Don’t want to do it yourself? Go to our contact page or call us at (888) 515-4829.

For immediate help call (888) 515-4829 and we’ll assist you. You can also fill out the form below.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Hi, this weekend is good for me, since this point in time i am

reading this enormous informative article here at my home.

Also visit my web site; nordvpn coupons inspiresensation (t.co)

What’s Going down i am new to this, I stumbled upon this I’ve found It

positively useful and it has aided me out loads.

I’m hoping to give a contribution & help different customers like its aided me.

Good job.

My web-site – nordvpn coupons inspiresensation, shorter.me,

Howdy, I think your website could possibly be having web

browser compatibility issues. When I look at your web site in Safari, it looks

fine however, when opening in I.E., it’s got some overlapping issues.

I merely wanted to give you a quick heads up! Aside from that, excellent website!

Review my homepage :: nordvpn coupons inspiresensation [t.co]

Write more, thats all I have to say. Literally, it

seems as though you relied on the video to make

your point. You definitely know what youre talking about, why waste your intelligence on just posting videos to your

blog when you could be giving us something informative to

read?

my website :: nordvpn coupons inspiresensation

350fairfax nordvpn special coupon code 2025

Hi there are using WordPress for your site platform?

I’m new to the blog world but I’m trying to get started and set up my own. Do you require any html

coding knowledge to make your own blog? Any

help would be really appreciated!

Novices are advised to begin on the decrease end of this vary to evaluate tolerance, progressively rising the dose as their physique adapts.

Advanced customers may select greater doses, but this comes with elevated danger for

adverse reactions and must be approached with caution (Hickson, Medication and Science in Sports

Activities and Exercise). Anavar is widely utilized in managing muscle-wasting diseases, corresponding to those brought on by HIV/AIDS and sure cancers.

These situations often end in cachexia, a syndrome marked by severe muscle atrophy and weight loss.

We have seen Anadrol add 50+ pounds to compound lifts (on its own).

Gynecomastia is possible on this cycle as a end result

of testosterone aromatizing. Thus, excessive estrogen ranges may trigger breast tissue to

enlarge in males. In this article, we’ll detail the highest 5 trenbolone cycles we

now have seen bodybuilders use to bulk up and get ripped.

There are uncommon stories of harm to a fetus when the mother took different corticosteroids.

Infants born to moms who have been using high doses of beclomethasone for an extended time might have

hormone problems. Tell your doctor when you notice symptoms similar to persistent nausea/vomiting, extreme diarrhea, or weakness in your newborn. However, like

different anabolic steroids, Anavar can nonetheless psychologically have an result

on customers. Some folks could develop a psychological dependency,

by which they strongly need to proceed utilizing the substance to maintain up their perfect physique or enhance

their performance. Even without bodily habit,

this could lead to a behavior of recurrent use. Anavar also can result in severe issues, such as a situation often known as edema, during which the physique retains additional water

and doubtlessly increases the chance of heart issues.

This is due to Anavar being 5α-reduced; thus, it does

not aromatize, meaning estrogen ranges remain steady. This is beneficial for bodybuilders seeking a lean and outlined physique.

It can be appealing to athletes who don’t need additional water weight when performing.

Treatment with increasing doses of both QVAR and CFC-BDP resulted in increasedimprovement in FEV1 , FEF (forced expiratory flow over 25-75% of

the vital capacity) and asthmasymptoms.

Before starting Anavar, inform your physician about all drugs,

supplements, and well being points. The duration of time Anavar may be

detected in your system is decided by various elements, together with dose, frequency of use, metabolism, and the sort of

drug take a look at used. Following are some tough estimations concerning Anavar detection home windows.

It can lower good ldl cholesterol (HDL) and elevate unhealthy cholesterol (LDL), thus increasing the danger of heart problems.

Anavar should be used with caution by individuals who already

have cardiac problems.

Anavar, because of its wide number of results, can be utilized

to your targets whether you’re slicing, bulking, or you’re male

or feminine. It’s one of many mildest compounds available to the steroid consumer,

and for that purpose, it can be used for an extended period if blood work is done and organs and blood stress is checked often.

It just isn’t unprecedented to run Anavar for ten or so weeks increasing the dose

over time to prevent the onset of a tolerance build up with a

testosterone preparation, corresponding to Sustanon. While Anavar’s suppression of natural testosterone is less severe than different

anabolic steroids, it nonetheless occurs. Signs

of low testosterone post-cycle can embrace fatigue, low libido, and muscle loss.

Incorporating PCT helps the physique resume pure testosterone production and helps long-term well being

and efficiency (Bhasin, Journal of Medical Endocrinology & Metabolism).

While off-season Anavar for ladies may be incredible, without query it is through the dieting course of that

it actually shines.

In 17 youngsters (mean age 10 years), theCmax of 17-BMP was

787 pg/ml at 0.6 hour after inhalation of a hundred and sixty mcg

(4 actuations of the 40mcg/actuation strength of HFA beclomethasone dipropionate).

The systemic exposure to 17-BMP from160 mcg of HFA-BDP administered

without a spacer was similar to the systemic publicity to 17-BMP

from 336 mcgCFC-BDP administered with a large quantity spacer in 14 kids (mean age 12years).

This implies that approximately twice the systemic publicity to 17-BMP can be anticipated forcomparable mg doses of HFA-BDP without

a spacer and CFC-BDP with a big volumespacer. Sufferers requiring

oral or other systemic corticosteroids ought to be weaned slowly

from oral or othersystemic corticosteroid use after transferring to QVAR.

Lung perform (FEV1 or PEF), beta-agonistuse, and bronchial asthma

signs ought to be fastidiously monitored during withdrawal of oral or different systemiccorticosteroids.

CrazyBulk is our recommended supply for authorized dianabol steroid cycle (https://mitsfs-wiki.mit.edu/index.php?title=Anavar_Vs_Anadrol:_Which_Is_Better_A_Comprehensive_Comparison) alternatives, primarily

based on hundreds of positive reviews on verified platforms corresponding to Trustpilot and Feefo.

Anavar increases T3 by reducing TBG (thyroid-binding globulin) while simultaneously raising TBP (thyroxine-binding prealbumin).

If you undergo from hypogonadism and require testosterone for medicinal functions, we recommend Olympus Men’s

testosterone substitute remedy (TRT) program.

Nevertheless, in 1995, Anavar made a comeback, returning to pharmacies underneath the model name Oxandrin,

now produced by BTG (Biotechnology Basic Corp.).

BTG organized a take care of Searle the place they’d continue manufacturing the

steroid but would distribute it exclusively to BTG, thus selling

it underneath a brand new firm name.

In terms of fee, you should purchase anabolic steroids online within the Usa at eversteroids.com

utilizing PayPal, American Express, MasterCard, or Visa.

Steroids, also referred to as anabolic-androgenic steroids (AAS), are synthetic derivatives of testosterone, the primary male sex hormone.

These compounds are designed to mimic the consequences of

naturally occurring testosterone, enhancing muscle development (anabolic

effects) and selling male bodily traits (androgenic effects).

You have most likely heard that steroids are

dangerous or that it isn’t value it. But that´s only the

type and model of steroid – there´s nonetheless different factors that will play into how a lot

someone ultimately pays for their steroids. However, its mild nature and

high tolerance amongst men and women make it a popular steroid from

a security perspective.

These compounds promote muscle growth (anabolic effects) and enhance male characteristics (androgenic effects).

They are generally used by bodybuilders, athletes, and gym fanatics to spice up efficiency

and achieve a lean, muscular physique. Some athletes, bodybuilders

and others misuse these drugs in an try to reinforce efficiency and/or improve their

physical appearance. Anabolic steroids are the commonest

appearance- and performance-enhancing medicine (APEDs).

Approximately three to four million folks in the Usa use anabolic steroids for nonmedical

functions. We know you want reliable injectable testosterone and effective oral steroids, and we have got you coated.

Dianabol stays probably the greatest steroids for building

muscle and bulking up. One of the best steroid Supplements sites to buy steroids on the web is Top-steroids-online.

Amongst the various steroids on provide on this web site,

Anavar is one bodybuilder beginner steroid that’s in stock and available for delivery.

Under are a variety of the websites to buy actual steroids online

within the USA. The solely means to make use of steroids legally is to have a prescription for them.

This steroid supplement is incredibly versatile and could be stacked with another

legal steroids from Large Diet, though it actually works especially properly when paired

with arachidonic acid.

What should I declare to US border agents when crossing again with my medication? When returning to the US, border

agents will ask about gadgets brought from Mexico.

It is necessary to declare all prescription medicines obtained in Mexico,

along with another gadgets acquired in the course of the visit.

However in the Dominican Republic, OTC medicine are pretty much the identical factor as vitamins.

The story was basically the same in the four pharmacies I visited in La Romana.

Due To This Fact, the monetary price of experiencing

reasonable positive aspects could be very excessive. Dianabol was first created to be considerably extra

anabolic than testosterone but with less androgenicity. If there’s one

thing Crazy Bulk might do to improve, it might be to decrease their costs even further and enhance their average review score from four.4/5 to 5/5.

We sincerely hope to give you a smoother experience on your

next orders. Your satisfaction with the quality of the objects and the discretion of

the packaging is much appreciated. That stated, we absolutely understand your frustration about processing

instances and the dearth of initial visibility.

Pharma Sust 300 is an efficient anabolic steroid based mostly on four specific

forms of Testosterone, which is normally referred to as Sustanon. Each of the types has a unique absorption price,

which ensures a long-lasting effect. The drug significantly will increase bodily

performance and is right for energy sports.

It is primarily used in a mass-gaining courses and is likely one of the leaders amongst anabolic steroids.

There, they tell the cell to make different proteins via attaching to small molecules referred to as receptors.

When the anabolic steroid attaches, or binds to

the receptor, the cell knows it’s time to alter what proteins it’s making.

All of your cells make protein, and they’re important for all structure and performance.

Anabolic steroids must bind to receptors in skeletal muscle, the

muscles in our legs and arms we use for lifting, to

trigger the adjustments in protein production. In muscle cells, anabolic steroids enter the nucleus and alter how a

lot of sure proteins are made. Proteins which would possibly be

concerned in building muscle are upregulated, meaning the steroids ‘up’ the variety of them being

made. Proteins that are concerned in breaking down muscle are downregulated,

meaning much less of them are made.

It is also essential to read reviews from previous consumers so that

you realize if they got the actual deal or if they were scammed.

If you are coping with a vendor who isn’t exhibiting up

wherever, they could be fake distributors, and you need to cease the transaction immediately.

The first step to check if the steroids you’re just

about to purchase are pretend or actual is to have a look

at the expiration dates. For the fakes, the expiration dates might be printed on the unique printing on the package deal.

However for actual steroids, it will by no means be the case, as the expiration date

will be added later to the unique printing on the packaging utilizing

a stamp. You Will soon start receiving the newest Mayo Clinic health data you requested in your inbox.

Injectable steroids are administered through

intramuscular injection and are preferred by many athletes for their longer duration of motion and decreased liver toxicity.

Oral steroids are available in pill or capsule kind, making them handy and straightforward

to use. Nonetheless, they are metabolized by the liver, which might lead to pressure

on this organ if not used responsibly. However, these are costly steroids and

infrequently counterfeited; thus, injectable testosterone is the popular choice for a lot of of

our patients. As you can think about, there are many scams and underdosing of products, making it difficult to discover a dependable

source. Winstrol is considered a seashore physique

steroid, with it quickly lowering a user’s physique fat proportion whereas additionally

possessing diuretic results (due to a lack of aromatization).

Winstrol (stanozolol) is the second most widely used oral steroid (after Dianabol) and is predominantly used as a chopping agent.

Anadrole re-creates the effects of Oxymethalone (known as Anadrol, one of the most powerful anabolic steroids in existence) however

without the side effects. Step on the human progress hormone gas, fire up muscle progress and burn by way of fats shops.

Anavar may help you carry heavier weights, which might help you construct extra muscle

mass and increase your general power. Moreover,

Anavar can help you get well extra rapidly

between exercises, which might help you train more durable and more regularly.

One of the the reason why Anavar is so well-liked is as

a outcome of it’s a relatively safe steroid. It has a low threat of causing liver injury, and it doesn’t aromatize (convert to estrogen) within the physique,

which means that users don’t have to worry about growing gynecomastia (male breast tissue).

Purchase Anavar to get very lean gains with no bloating

and ideal as an addition to any cycle.

Some customers choose to complement their steroid cycle with testosterone to sort out this concern. However, proceed with warning as this introduces one

other agent within the equation and can convey

alongside its share of penalties. If you’re contemplating

taking Anavar, it’s important to know the potential advantages.

Anavar is a popular steroid that is identified for its ability that

can assist you achieve muscle mass, lose fat, and enhance your power and

endurance. Anavar has the power that can assist you lose fats and

gain power, however it could also make you retain water in your body if not monitored correctly.

The cause is that Anavar has anabolic properties that

assist with fats loss while Winstrol does less in this regard.

This debate is one that has been round for many years now, with no clear winner between the 2 anabolic steroids.

Anavar’s non-aromatizing nature reduces the risk of gynecomastia, but its

oral supply can stress the liver.

The results of these substances differ depending on the specific steroid, dosage, and individual characteristics.

By embracing these optimum dosages, each men and women can experience the

optimistic effects of Anavar whereas mitigating potential risks.

Males aiming for enhanced physique and efficiency commonly uncover that a every day dosage ranging

from 20 to 100 mg proves extremely effective over a period of 6 to 12 weeks.

There is a danger when purchasing any anabolic steroid side effect (fairhuurvoorverhuurders.nl) on the black market; nonetheless, it

might be argued that Anavar is particularly precarious as a outcome of its excessive market value.

In Anavar’s case, it is because the kidneys assist to course of oxandrolone, decreasing the hepatic toxicity and

workload on the liver. In oral kind, undecanoate may be very fast-acting, with plasma

testosterone ranges peaking approximately 5 hours

after a dose. The solely draw back for some newbies is that testosterone is predominantly an injectable steroid.

Therefore, if users want to take orals throughout

their first steroid cycle, Anavar and Dianabol can be most well-liked choices.

Most underground labs will carry the same tab or capsule for

round one to 2 dollars per tab.

There are authorized alternate options which may be safer and even more efficient than products containing oxandrolone.

People carry various ranges of response some might show symptoms

no matter accountable use and should discontinue use instantly in order to defend their femininity.

In order to obtain the constructive results of anavar while minimizing the side effects most males will need a big dose due to its extraordinarily mild

nature to have the ability to get hold of athletic enhancement.

A somewhat gentle steroid, oxandrolone is a dehydratase dosteronederivative

and is certainly one of the most side-effect pleasant steroids available on the market.

Carrying a very mild androgenic nature with almost no androgenic exercise.

However, it is still obtainable on the black market and can be

used with no prescription if it is obtained from a trusted source.

There have been no reported instances of Anavar toxicity in Turkish athletes, but there

is at all times the potential for side effects whether it is

taken without correct guidance from a health professional.

Many individuals mistakenly imagine that the first goal of

using steroids is to build substantial muscle mass.

Nevertheless, positive aspects from steroids encompass more than just muscle

measurement; they’ll additionally involve general physique transformations or enhancements

in athletic efficiency. In the realm of performance enhancement,

Anavar is highly favored amongst athletes.

A widespread scam we have been made aware of is dealers labeling products as Anavar, however the uncooked ingredient is Dianabol.

Dianabol is a very cheap oral to produce; thus, by deceiving individuals on this method, sellers can dramatically improve their profit margin. Anavar produces great

outcomes, particularly when it comes to energy and pumps.

Take 3+ grams of fish oil and do your cardio, and cholesterol shouldn’t be a problem, even when you’re delicate to your lipids.

On the adverse side, even with a relatively mild profile, Anavar may cause quite so much of unwanted side effects.

It can result in the suppression of the body’s natural testosterone manufacturing, probably leading to

hormonal imbalances. Since Anavar is taken orally, it places stress on the liver, and extended

or excessive use may cause injury. It also can impact cholesterol levels,

probably rising the risk of cardiovascular issues.

Tesamorelin – Primarily used for fat loss but in addition aids in muscle preservation. Utilizing ACE-031 responsibly inside structured cycles helps mitigate dangers and optimize

benefits. Accelerated Restoration – The peptide aids

in muscle restore, shortening restoration time after strenuous exercises and enabling extra frequent training periods.

Their platform is intuitive and easy to navigate, making the buying process

clean and efficient. Delivery is reliable, with

well-packaged items arriving throughout the expected timeframe.

Customer service is very responsive and skilled, ensuring that inquiries and issues are addressed promptly and effectively.

In phrases of pricing, Osgear strikes a stability between affordability and worth, making

it an excellent choice for shoppers on the lookout for competitive rates without compromising on quality.

There are some who will kick begin and use this steroid as a plateau buster but this isn’t one

thing we usually recommend. Absolutely, it will work

but a Dianabol cycle can be quite toxic to the liver

and it is suggested use be kept short and brief as to take care of optimum liver well being.

Weakened Tendons and Ligaments – Fast muscle growth could surpass

the physique’s capacity to strengthen tendons and connective tissues, doubtlessly leading to pressure or damage.

Your way of life is another massive factor that is usually overlooked when planning

a steroid cycle. Anabolic steroids can put plenty of stress on the physique, particularly the more potent

compounds, so it is important to stay a healthy, energetic way of life.

Not solely will this assist to limit the risk of unwanted aspect effects,

but it’ll also ensure you get the very best outcomes.

DHT primarily based steroids corresponding to Masteron and Primobolan can also present anti-estrogen effects, as DHT and estrogen will compete for the same receptors in the physique.

Sensitivity to estrogen is a very common problem when it comes to steroids, many users will

experience some type of estrogen related side effect sooner or later throughout

their time using steroids and sex (http://jointjedraaien.nl).

In this Equipoise cycle, it’s the conjoined relationship of numerous

compounds that can produce the desired results. This may

also be the time when compounds like Clenbuterol and Cytomel will wish to be

strongly considered. PCT stands for submit cycle therapy, means Therapy to

restart the pure manufacturing of testosterone

and different hormones. Sermorelin – Encourages natural GH

manufacturing, supporting recovery and lean muscle gains.

This is the place features are slow, otherwise you feel

like you’ve come up against a wall and can’t make further progress regardless of how hard your

exercises are getting. Somewhat than continuing the cycle

with little to no features, adding Dianabol provides a substantial enhance.

It can knock that plateau wall down and quickly make your positive aspects lookup

once more.

A Stage 1 Equipoise cycle for slicing will symbolize a

wonderful plan for preserving lean mass. With the addition of Anavar on the finish, once lean the individual may also find he’s a lot harder and

way more outlined. Though not listed in the plan, this is a wonderful time to suppose about thermogenics

like Clenbuterol and/or thyroid hormones like Cytomel (T3).

Regardless of your experience with anabolic steroids, most any healthy adult man will be succesful of implement this Equipoise cycle.

It might also prove very helpful for the aim of athletic

enhancement.

Nonetheless, it wasn’t lengthy before bodybuilders observed the anabolic results in animals and started experimenting on themselves.

Such checks had been an enormous success, although their positive aspects got here

at a cost (experiencing harsh facet effects).

To use HGH primarily for muscle growth functions, you’ll want a bare minimal of 12 weeks.

The combination of trenbolone and Anavar

makes for an effective cutting cycle. Both trenbolone and Winstrol don’t aromatize,

so water retention won’t be an issue, resulting in an outlined

and dried-out physique as a substitute, with enhanced vascularity.

We have seen this duo utilized as a chopping cycle, the place users eat in a calorie

deficit. We have additionally seen it used as a lean-mass

building cycle, the place users eat maintenance energy

(or in a small surplus). The risk of androgenic unwanted effects, similar to hair loss, pimples,

and prostate issues, can be excessive. This cycle is used by bodybuilders who wish to gain massive quantities

of mass and have the genetics to tolerate Anadrol and testosterone relatively well.

All of the advantages of a trenbolone/Anadrol cycle apply,

but to an extra stage with the addition of testosterone.

Growth hormone could be very useful for experienced steroid customers who’ve achieved

a high stage of physique enhancement and the place additional development or progress seems to have come to a halt using steroids.

The addition of HGH can propel the superior bodybuilder

past current limits when utilized in mixture with powerful steroids.

Deca Durabolin is definitely delicate and appropriate for newbies; however, it isn’t sometimes

used by itself. Instead, it can be stacked with testosterone or Dianabol for increased muscle features.

However, you wouldn’t typically stack this as your first

steroid cycle but rather as a later cycle.

Some females are recognized to take 10mg and have it tolerated, however be ready for some unwanted effects to develop.

If, for whatever purpose, you wish to go together

with injectable Winstrol over oral (perhaps to avoid liver toxicity), 20mg each 4 days is a perfect dose.

Whichever type of Winstrol you’re taking, the really helpful cycle

size is 4 weeks, with six weeks being the utmost.

A 50 to 100mg per week is appropriate for most females to take pleasure in the benefits

whereas reducing the negatives to a minimal or non-existent degree.

A cycle of 6 weeks at a naked minimal is needed to

get probably the most from Equipoise due to its slow-acting

nature. However you should use this steroid as much as weeks at

low doses – keep watch for those virilizing signs over that size of time, significantly if you’re taking a dosage at the

larger finish of the range above. Steroids play a job in optimizing the nutrient

pathways of the body by effectively shuttling vitamins to

muscles that are giving the signal that protein synthesis is being initiated21.

In this case, our patient’s physique temperature

increases by roughly 1 degree. We discover that fats loss ceases roughly

4-6 weeks right into a cycle when the body inevitably reaches homeostasis and cools down. This is

why bodybuilders typically cycle clenbuterol for short durations, with brief protocols of 2 weeks on and a pair of

weeks off.

CrazyBulk’s formulation are supported by scientific research and are protected for men and women to make use of.

Anavar can also be utilized by ladies, as it is much

less likely to cause virilization at low to moderate dosages.

Testosterone is androgenic in nature; thus, we generally observe irritation of the prostate, acne vulgaris,

and male sample baldness in patients. Nonetheless, one

of the best steroid should not be considered as the most highly effective however as one that can provide customers the most results with the

least quantity of injury. Nonetheless, cosmetically speaking, one of the best steroids to take will depend upon an individual’s personal objectives.

Dianabol is considered the best for bulking.Which steroid

for big muscles? Anadrol is commonly used for big muscle gains.What

is the safest steroid bulking cycle? A cycle utilizing

testosterone and Deca Durabolin is considered protected for bulking.What is the most effective steroid cycle?

In 2001, a CDC survey reported that as a lot as 5% of

all high students in the US had used steroids without

a doctor’s prescription. Other surveys revealed that

1 to 3 million Individuals use steroids. the best steroids on The Market use of steroids is quite well-liked and has

been so for a selection of years now. Trenbolone additionally provides the

muscles a dry appearance as a outcome of its lack of

aromatization, which produces a diuretic effect.

Oral steroids are controlled in all places apart from in a prescription. But

there are lawful over-the-counter ones you’ll be able to trust that can equally provide the same end

result with out hazard.

Sadly for them, steroids will always cause some unwanted side effects.

We discover androgenic steroids to be the worst for accelerating hair loss due

to them being DHT derivatives or having excessive levels of the 5α-reductase enzyme present.

Nevertheless, steroids have an result on individuals in different ways, and a few customers don’t experience elevated outbursts of anger but instead more common circumstances of

irritation and grumpiness. We haven’t found roid rage to be a concern for many of our sufferers.

This is due to considerably higher testosterone ranges, the male hormone that’s responsible

for elevated levels of aggression. However, different steroids used in bodybuilding have high ranges of toxicity and aren’t FDA-approved.

Consequently, a bodybuilder will appear extra muscular as tone will

increase and waist dimension noticeably decreases. Tbol doesn’t aromatize,

and thus it causes no water retention and decreases the risk of gynecomastia forming, which is the other

of Dianabol. Excessive doses don’t at all times yield better results — they only enhance side effect severity.

By putting your metabolism into overdrive, your physique is ready to use your stored fats for power.

These embody being jittery, shaking palms, feeling wired, and having insomnia.

Thus, taking the steroid at night or late within the day just isn’t really helpful.

Until natural testosterone ranges return to regular, users

are advised to chorus from taking some other

steroids and implement post-cycle therapy during this era.

This mixture of testosterone and Deca Durabolin is the least toxic bulking stack in our experience.

Intermediate customers will commonly administer this stack as soon as their physique comfortably tolerates testosterone-only cycles.

Since testosterone is injectable, it is not probably the

most handy anabolic steroid. Nonetheless, this technique of entrance allows it

to reach the bloodstream promptly, bypassing the liver, unlike C-17 alpha-alkylated steroids.

As a result, testosterone has minimal hepatotoxic effects, evidenced

by our liver function exams (1). Superdrol is an applicable name for this steroid

concerning strength features.

Thus, legal steroids are a safer different to anabolic steroids and promise similar benefits with no main risks.

With the best legal steroid, individuals can obtain their muscle

development goals safely and successfully. DecaDuro is simple to take and is a pure formula, together with

Wild Yam Root,(9) making it one of the top-rated authorized steroids for

building muscle. Since it’s a pure method, there is not any want

to fret about the potential dangers of utilizing anabolic steroids.

It is a must-try for any bodybuilder or health fanatic who is serious about enhancing their workouts and gaining muscle mass.

Testo-Max can be distinctive because it is a safe and legal different to

conventional anabolic steroids. It does not result in any unfavorable side effects that can harm

your well being in the long term.

No B.S. They ship your order and it arrives inside every week every time.

It’s the most highly effective and looks like you’re on some “real juice” without the unwanted aspect effects.

After a week, I noticed that my bench press was up 10%, and my endurance had significantly elevated.

DBulk is another Dianabol alternative to consider if you want to

build serious muscle without the typical side

effects. I was capable of lift heavier weights and push by way of extra reps with

less fatigue, and my post-workout restoration was

quicker. During the primary week, I observed a gradual enhance in my power levels

and an improvement in my sleeping sample.

Arguably the harshest aspect effect of Anadrol is an upward surge in blood pressure.

This response is due to the steroid having a notable reducing impact

on HDL levels (the helpful type of cholesterol).

The reason why Anadrol isn’t listed as primary on this record

is because we have ranked steroids so as of execs vs.

cons.

Many sports activities are impossible to

compete in without the use of anabolic steroids.

With Out the help of anabolics, fashionable athletes and health lovers who wish to

have a wonderful body typically collapse trying to raise outsized

loads throughout training. Equipoise (Boldenone Undecylenate) increases urge for

food and accelerates metabolism, which of the following

compounds is not derived from cholesterol?, http://www.infreiburgzuhause.de,

ends up in quality muscle growth. The increase in muscle mass

can be from thirteen to 18 lbs from an Equipoise cycle. Facet effects

of steroids injections are less liver toxic than oral steroids.

We also provide our returning clients reductions and free bonuses

simply to level out our appreciation for selecting

us as their major steroid supplier. Obtain your bodybuilding targets and Buy Masteron Enanthate Online Canada from Omega Full Potential.

Buy T3 Cytomel Online Canada for weight reduction, metabolism boosting, and hypothyroidism reduction.

The excellent news is that Testol 140 is a pure, secure, and

authorized various to Testolone, that means no negative side effects.

I didn’t experience as a lot fat loss as

with D-Bal, however that wasn’t my major aim. Several studies have confirmed that zinc supplementation improves bodily efficiency and reduces recovery times.

You could possibly buy deca 300 on-line and different countries

the place there’s a legal loophole, but there’s the

issue of importing it in your country whether it is illegal.

With Deca Durabolin cycle that won’t occur since most of the muscles you gained are everlasting.

Figuring Out what these steroids are alleged to do is going that can assist you make the proper stacking selection.

However what can it do and the way is it totally different from the

opposite types of deca cycles out there?

This is essential to recollect as being caught utilizing

this banned substance can put you in hot water. In truth, former NFL participant Shawne Merriman was

punished for utilizing Deca Durabolin cycles a few years ago.

Dianabol works proper off the bat, with its results turning into apparent in the first two weeks of the cycle.

Anadrol additionally makes up for the slow-moving action of Deca by offering dramatic positive aspects at

the start of the cycle. But dosing Deca durabolin injectable steroid has turn into a problem for a lot of men, even for superior steroid customers.

A take a look at cypionate cycle is designed that can assist you gain muscle

mass, enhance power, and enhance performance. Browse through

our classes and discover the steroids and supplements

that may allow you to obtain your health goals and improve your total well-being.

Obtain your bodybuilding targets with Letrozole – a robust supplement from Omega Full Potential.

Increase testosterone, preserve muscle, and suppress urge for food with Gen Pharma HCG injections.

Perfect for cycles lasting 6-12 weeks, this product is your key to unlocking

peak efficiency and attaining your health targets. Elevate your coaching regimen with Trenbolone Enanthate from Omega Full Potential right now.

Steroids have lengthy been a cornerstone on the earth of bodybuilding and athletic efficiency enhancement.

70918248

References:

what do anabolic steroids do [https://Elainecentral.com/cultivating-intimacy-in-a-world-apart-nurturing-connection-in-long-distance-relationships/]

70918248

References:

best place to buy anabolic steroids online (https://techsings.com/)

70918248

References:

famous athletes who used steroids – tourslibya.com –

70918248

References:

is creatine a steroid – https://kissuilab.com,

70918248

References:

top steroids (Daniela)

70918248

References:

non androgenic steroids (ohoagency.com)

70918248

References:

none

Greetings from Idaho! I’m bored to death at work so I decided to browse your website on my iphone during lunch break.

I enjoy the information you provide here and can’t wait to take a

look when I get home. I’m amazed at how fast your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyways, amazing blog!

Here is my web-site :: eharmony special coupon code 2025

I’m amazed, I must say. Seldom do I encounter a blog that’s both educative

and amusing, and let me tell you, you have hit the nail on the head.

The problem is something that too few folks are speaking intelligently about.

I’m very happy that I came across this in my hunt for something

concerning this.

Here is my webpage: vpn