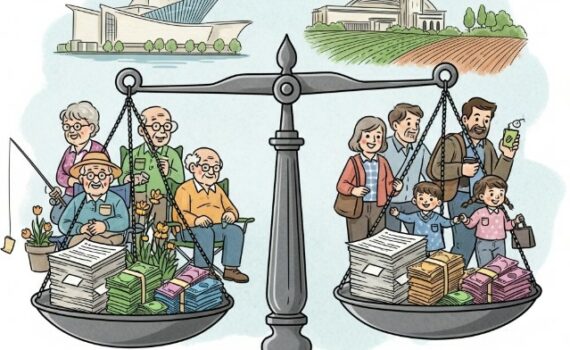

Wisconsin’s Tax Tango: Why Proposed Retirement Breaks Could Burden Working ...

Shifting Sands: A Closer Look at the Badger State’s New Budget and Its Tax Implications Wisconsin’s latest budget, […]

Shifting Sands: A Closer Look at the Badger State’s New Budget and Its Tax Implications Wisconsin’s latest budget, […]

Washington, D.C. – As the “One, Big, Beautiful” (OBBB) reconciliation bills move through Congress, lawmakers are proposing a […]

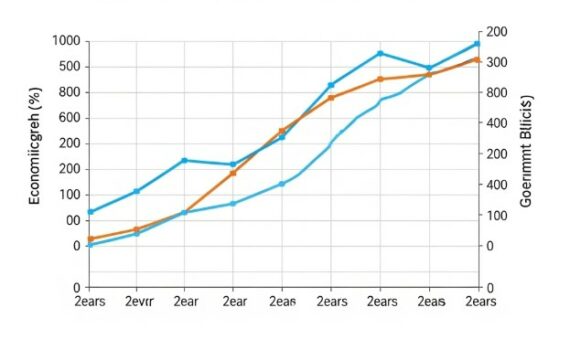

The OBBB aims to boost the economy, primarily by preventing large tax increases that would otherwise occur due […]

In a June 16 letter to key members of the U.S. Senate Finance Committee and Colorado’s congressional delegation, […]

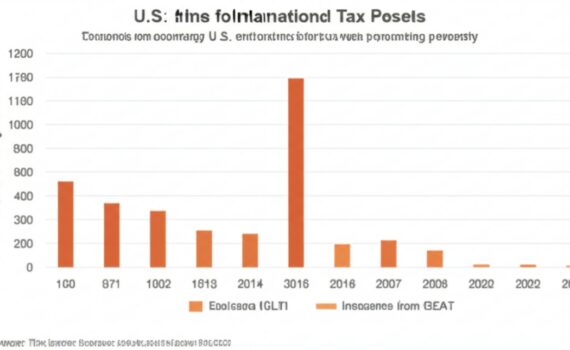

The Senate Finance Committee has released its draft bill, proposing significant and largely permanent changes to U.S. international […]

Senator Ted Cruz (R-TX) recently reintroduced the Cost Recovery and Expensing Acceleration to Transform the Economy and Jumpstart […]

A recent move by the Senate is set to provide significant relief for pass-through businesses navigating the State […]

The House-passed tax bill proposes three significant Section 199A Deduction Changes aimed at making the deduction permanent and, […]

Florida, the Sunshine State, beckons with its beautiful beaches, vibrant cities, and a promise of perpetual summer. Yet, […]