IRS Form 433-B (OIC) 2023 Version Instructions: Business Offer In ...

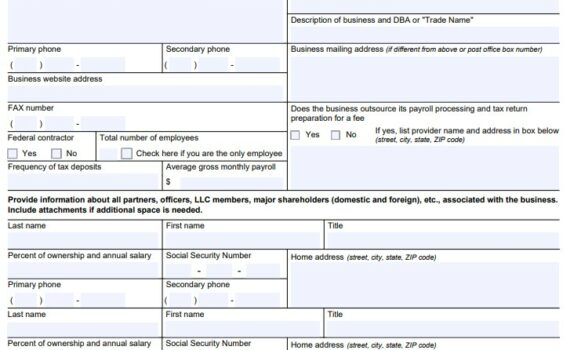

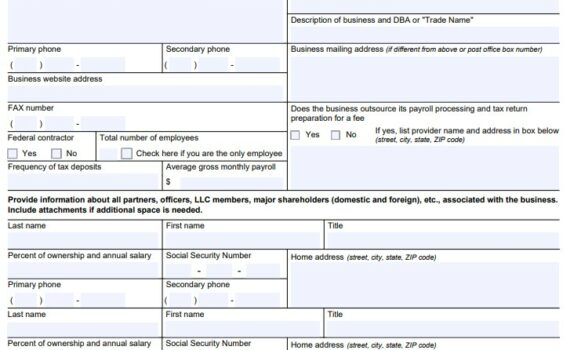

IRS Form 433-B (OIC) is the financial information statement for an IRS Business Offer In Compromise. This 433-B […]

IRS Form 433-B (OIC) is the financial information statement for an IRS Business Offer In Compromise. This 433-B […]

Settling NYS taxes can be a difficult task. New York State takes a much harder look at submitted […]

When you owe back due tax debts to the State of New York and take no action it […]

Whether your tax debt with the IRS is a recent accumulation or you have several years of back […]

If you’re experiencing tax debt issues with the IRS, often debts are also owed taxes within the state […]

In order to get an Offer in Compromise for federal tax debt, you need to make sure your […]

California Tax Debt Forgiveness: Is It a Real Thing? California will forgive tax debt via a Franchise Tax […]

Your Options for NYS Tax Debt Relief There are five main options when it comes to NYS tax […]

Types Of Offer in Compromise Offer in Compromise is a settlement for tax debts less than the amount […]