Virginia Legislative Alert: Proposed Tax Hikes Could Make the Commonwealth ...

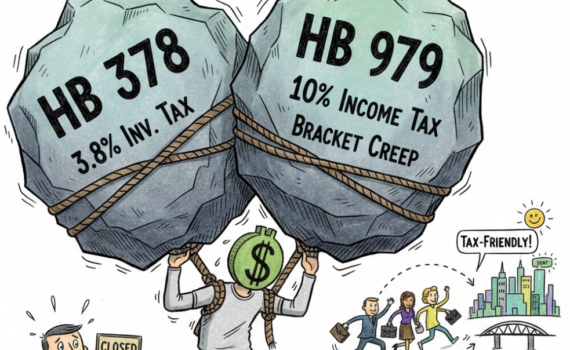

Virginia’s 2026 legislative session is in full swing, and despite campaign promises from across the aisle to prioritize […]

Virginia’s 2026 legislative session is in full swing, and despite campaign promises from across the aisle to prioritize […]

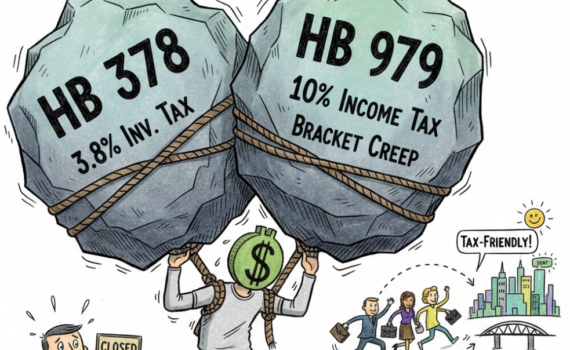

The latest analysis examines the Republican Study Committee’s (RSC) new policy blueprints—the 2026 Budget and the Reconciliation 2.0 […]

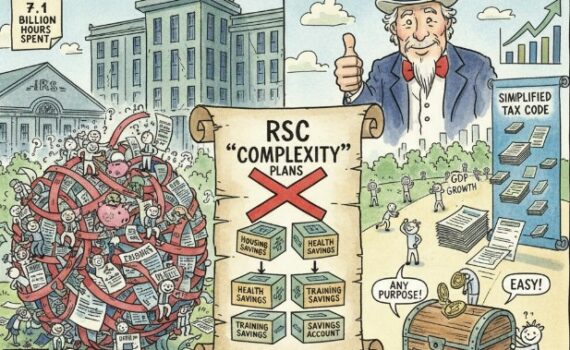

The tax landscape is ever-changing, and as we look ahead to 2026, several key areas deserve your attention. […]

The CTC is designed to offset the costs of raising children. It isn’t just a deduction; it’s a […]

As Americans prepare to file their 2025 tax returns this spring, many are in for a pleasant surprise. […]

Several states that previously opted to exempt international corporate income—specifically the tax on Global Intangible Low-Taxed Income (GILTI)—are […]

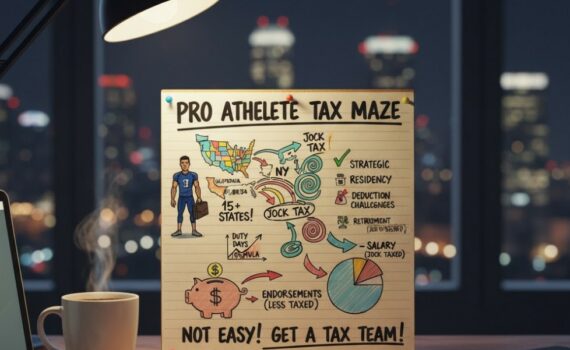

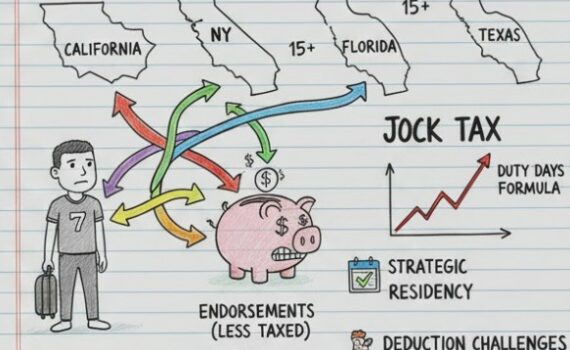

For professional athletes in the U.S., the glamour of the game often overshadows the mountain of paperwork that […]

For professional athletes in the United States, signing a multi-million-dollar contract is only the first step. The second, […]

Signed into law in July 2025, the One Big Beautiful Bill Act (OBBBA) introduces the largest set of […]