Decoding US Tax Updates: Your Comprehensive Tax News Guide USA ...

Ah, tax season! For many, it conjures images of overflowing shoeboxes, late-night number crunching, and a gnawing sense […]

Ah, tax season! For many, it conjures images of overflowing shoeboxes, late-night number crunching, and a gnawing sense […]

The recent House reconciliation bill includes a new fee on electric vehicles (EVs) intended to bolster the struggling […]

The highly anticipated “One, Big, Beautiful Bill” aiming to extend and modify the 2017 Tax Cuts and Jobs […]

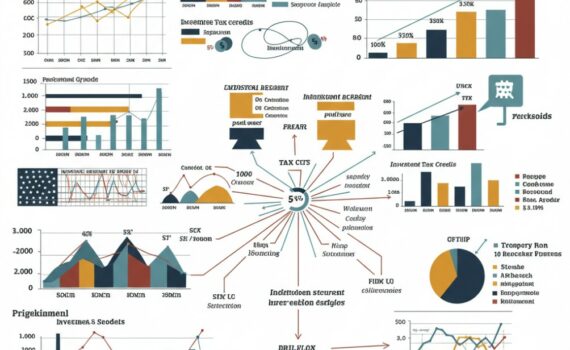

The House Ways and Means Committee has presented its comprehensive tax package, valued at over $4 trillion, which […]

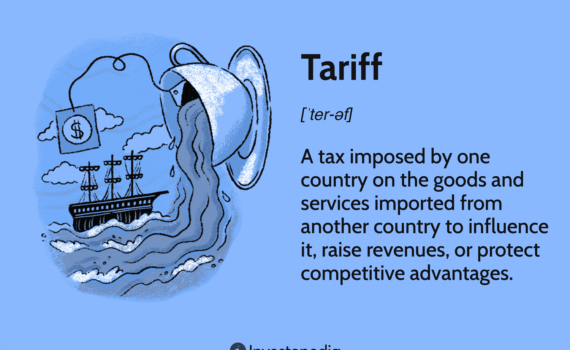

While the previous administration’s tariffs initially exempted crude oil and some energy-related minerals, these exclusions won’t shield the […]

With Congress currently focused on business investment incentives, a critical area for boosting economic growth lies in how […]

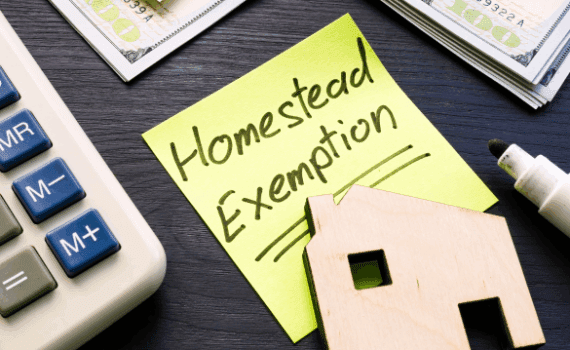

Georgia’s recent voter-approved Local Option Homestead Property Tax Exemption Amendment, designed to limit property tax assessment increases, has […]

The Tax Cuts and Jobs Act (TCJA) of 2017 brought significant changes to the U.S. tax code, but […]

The world of digital assets, from cryptocurrencies to NFTs, has exploded in recent years, and with it, the […]