Should I Hire a Tax Relief Company?

The number one problem when hiring a tax relief company is that they will close on you. Historically, […]

The number one problem when hiring a tax relief company is that they will close on you. Historically, […]

Here we answer the question: Should I hire a tax attorney? The answer depends on what you are […]

Many consumers are not aware that you can get your credit card debt canceled at all. However, those […]

Here we go through the basics of the IRS Fresh Start Program and where things are at in […]

During the 2020 COVID-19 / CoronaVirus pandemic, the United States IRS is offering a special plan regarding collections […]

If you are a taxpayer who owes back taxes, then you might have wondered at some point how […]

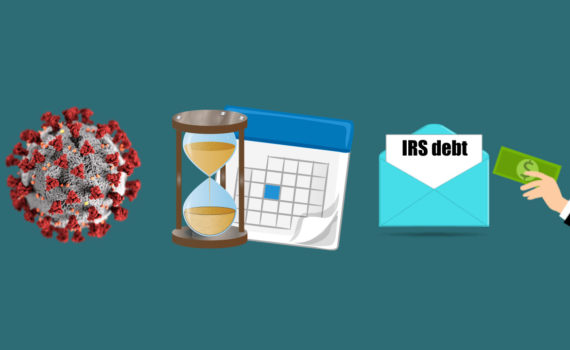

When the IRS sends you a CP508C Notice, it means that your unsettled tax debt has been reported […]

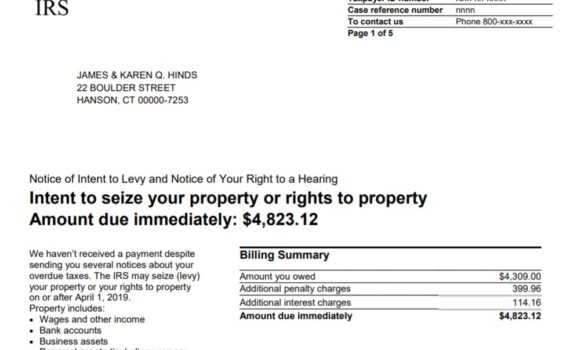

Getting an LT11 notice means that the IRS intends to levy your property or rights to property. It […]

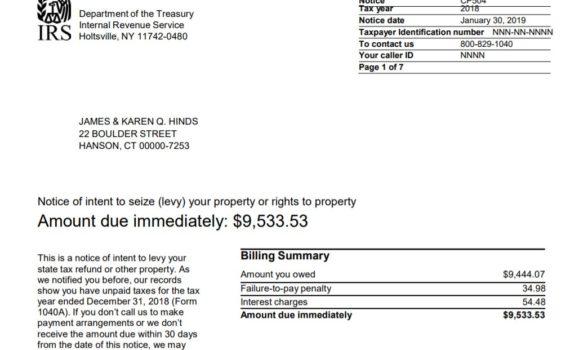

A part of the IRS duty is to remind taxpayers if they have any outstanding taxes. They send […]