Tax Debt Forgiveness: Four Most Common Options and How They ...

One of the programs that the IRS offers to those who cannot pay their tax debt is through […]

One of the programs that the IRS offers to those who cannot pay their tax debt is through […]

Where your collections case is handled depends on the balance and tax type. The IRS collections process can […]

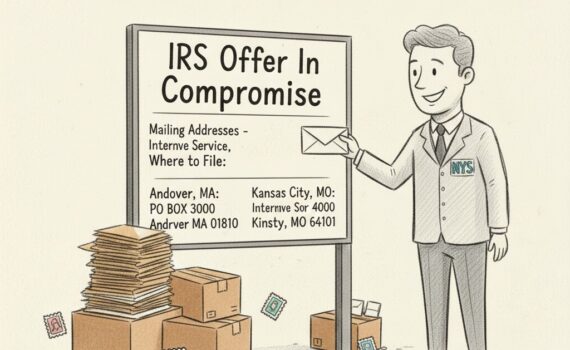

The mailing address for IRS Offer In Compromise changes depending on the state that you live in. There […]

Audit Insurance, also known as Audit Protection, is a service where the tax filer pays for insurance that […]

IRS Offers In Compromise is almost always easier to get than FTB Offers In Compromise. Here we go […]

Getting help with unfiled tax returns is tough. Many tax relief companies claim to help but are not […]

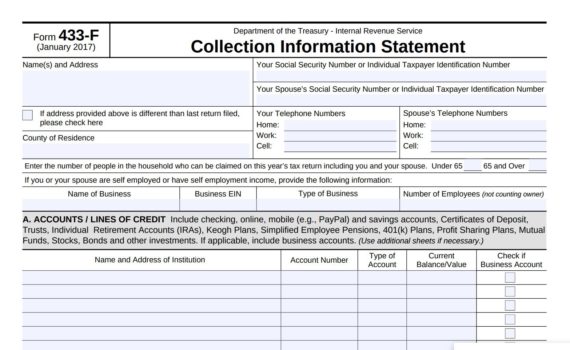

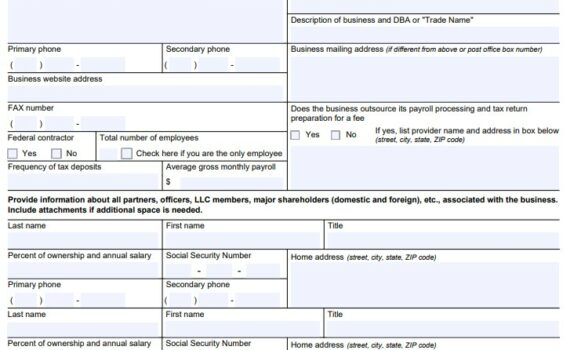

IRS Form 433-B (OIC) is the financial information statement for an IRS Business Offer In Compromise. This 433-B […]

Lots of people owe the IRS, but being assigned a revenue officer to your case means the IRS […]

Did you know that the Internal Revenue Service (IRS) sends out millions of wage garnishment notices every year? […]