Beat the Rush: Skip the IRS Phone Lines This Presidents ...

The IRS is alerting taxpayers that Presidents’ Day week (starting Feb. 16, 2026) is historically the busiest time […]

The IRS is alerting taxpayers that Presidents’ Day week (starting Feb. 16, 2026) is historically the busiest time […]

Elevating Tax Departments: The Power of Technology Corporate tax departments are under immense pressure. A shrinking talent pool […]

The recent Republican victory in the U.S. presidential election, with Donald Trump returning to office, signals a major […]

What is Form 1098-T? IRS Form 1098-T is a document issued by your U.S. school to report the […]

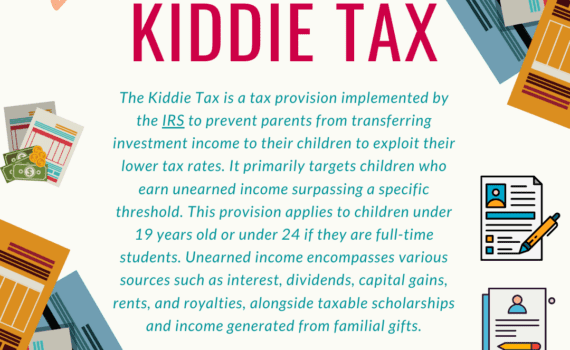

Understanding the complexities of taxation presents challenges for individuals across the board. Families with children encounter additional nuances […]

As any taxpaying veteran can tell you, dependents come in handy during tax season! They count as a […]

A CP 2000 is a letter from the IRS notifying you in the case where their figure of […]

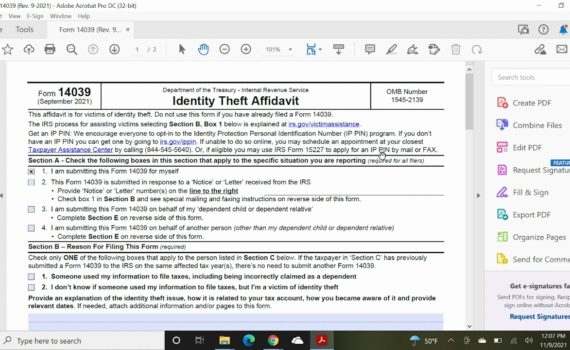

Identity Theft IRS Form - How To File IRS Identity Theft Affidavit Form 14039Watch this video on YouTube […]

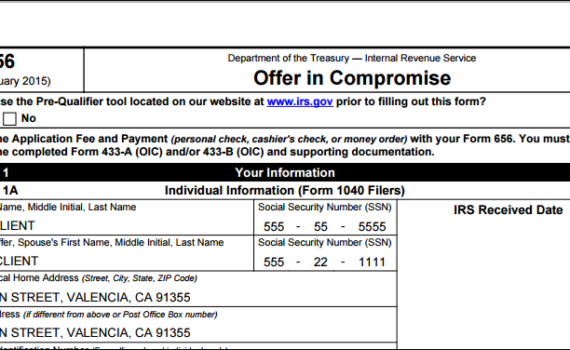

If you want to know how you can file for an Offer In Compromise, below you will learn […]