AI Taxation: Focus on Foundations, Not Science Fiction

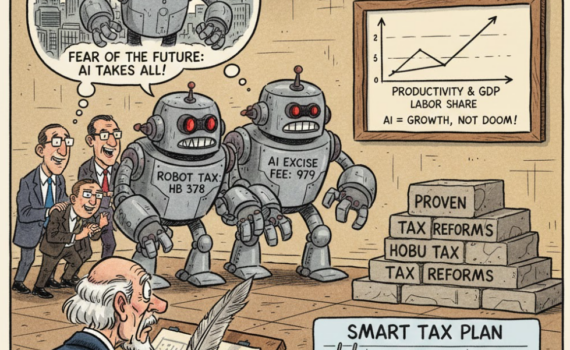

The rapid evolution of artificial intelligence has sparked a global debate, and tax policy is the latest arena […]

The rapid evolution of artificial intelligence has sparked a global debate, and tax policy is the latest arena […]

A new critique argues that while the White House Council of Economic Advisors (CEA) is right about the […]

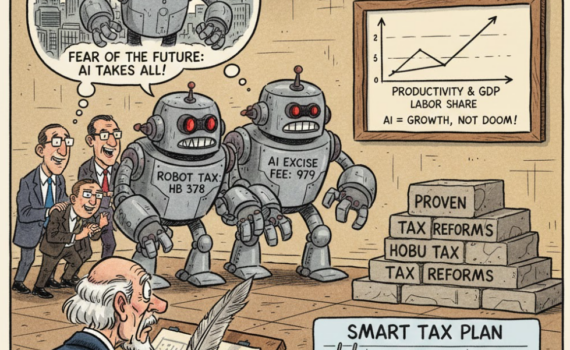

The tax landscape is ever-changing, and as we look ahead to 2026, several key areas deserve your attention. […]

As we enter 2026, the tax landscape in Europe is shifting from “temporary relief” to a permanent era […]

As we enter 2026, the tax landscape in Europe is shifting from “temporary relief” to a permanent era […]

The Qualified Small Business Stock (QSBS) exclusion (Section 1202 of the Internal Revenue Code) was intended to encourage […]

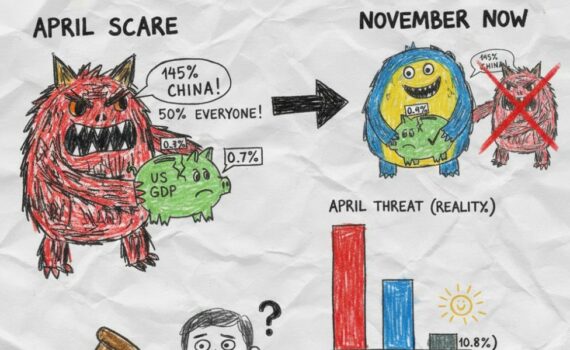

As of November 2025, the economic fallout from President Trump’s International Emergency Economic Powers Act (IEEPA) tariffs is […]

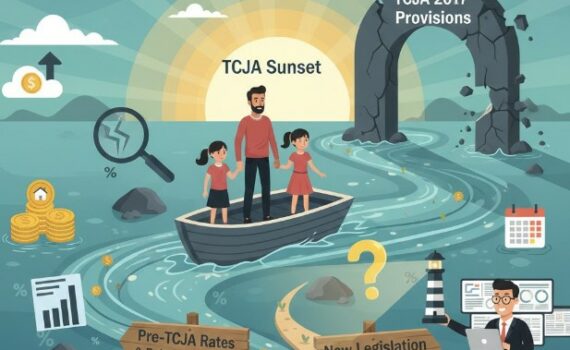

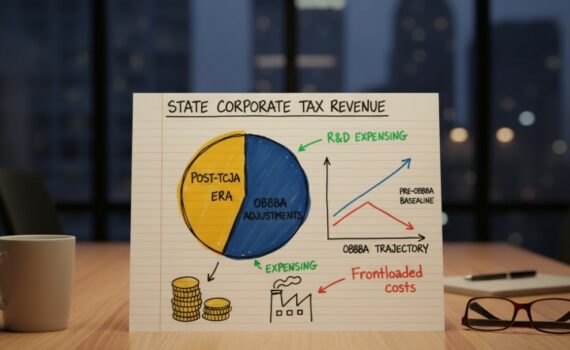

Some state lawmakers are considering decoupling from the business expensing provisions in the One Big Beautiful Bill Act […]

The Tax Foundation’s State Tax Competitiveness Index is more than a list of which states collect the most […]