Michigan Offer In Compromise Guide: Getting Your MI OIC Accepted

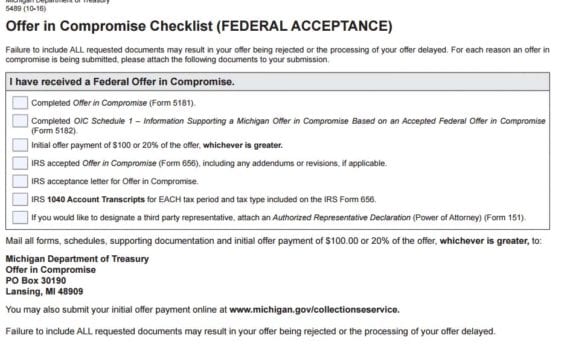

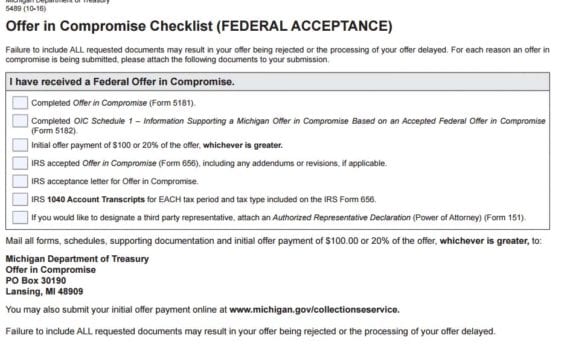

Michigan Offer In Compromise: The Easiest of The Bunch Getting a Michigan Offer In Compromise (OIC) is in […]

Michigan Offer In Compromise: The Easiest of The Bunch Getting a Michigan Offer In Compromise (OIC) is in […]

Blue Tax Closed: Another Tax Relief Firm Dies Blue Tax, a tax relief firm based in Los Angeles, CA, […]

Settling New York State Taxes: NYS Offer In Compromise In this guide, we will go through filing an […]

Filling out Form DTF 4.1 for NYS Offer In Compromise This guide is part of our NYS Offer […]

Filling out Form DTF 4 for NYS Offer In Compromise This guide is part of our NYS Offer […]

Personal Injury Settlements Are Mostly Not Taxable Is your personal injury settlement taxable? Compensation for your actual physical […]

Welcome to our ongoing series of comparing tax relief companies. Here we compare Legacy Tax and Resolution Services […]

They only have so long to collect…. thanks to CSED CSED stands for collection statute expiration date. This […]

You may need to file some missing tax returns and thus order IRS transcripts. It is often easier […]