IRS Certified Mail – Understanding Your Letter And Responding

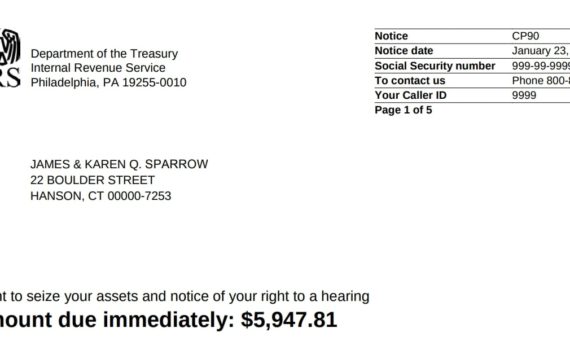

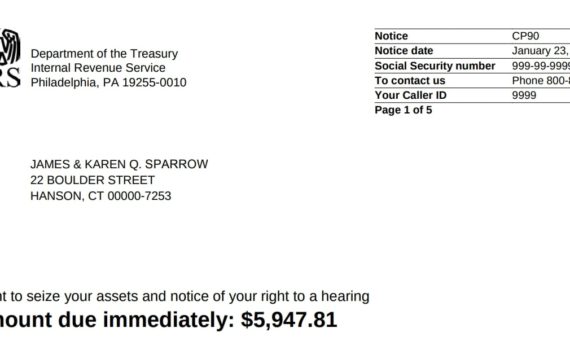

IRS Certified Mail Letters – Reasons and Responses Under certain conditions, the IRS will send letters through the […]

IRS Certified Mail Letters – Reasons and Responses Under certain conditions, the IRS will send letters through the […]

Here we go through the basics of the IRS Fresh Start Program and where things are at in […]

This question comes up a lot, as it’s advertised everywhere on the radio and TV that the IRS […]

Getting constant reminders from the California Franchise Tax Board (FTB) of your unpaid tax debt is not something […]

Getting an NYS tax lien removal through is not that easy. The way to get it done is […]

When you have a financial liability with the IRS, beginning your settlement is often the toughest step. Penalties […]

This article covers how to withdraw an IRS lien. If you have active liens and debts that are […]

When does the IRS file a lien? For purposes of back due tax personal tax debts, the Internal […]

Getting An IRS Lien Withdrawal Updated 12/28/2016 to Include Lien Office Information Update 6/9/2021: Credit reporting agencies no longer […]