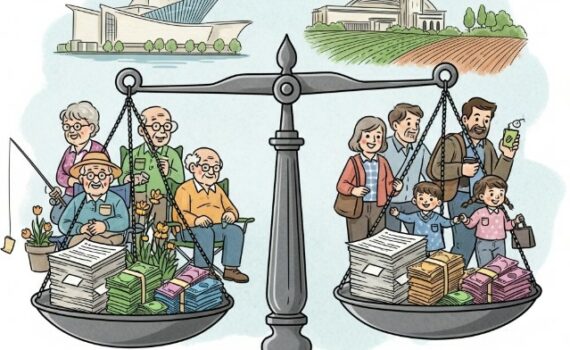

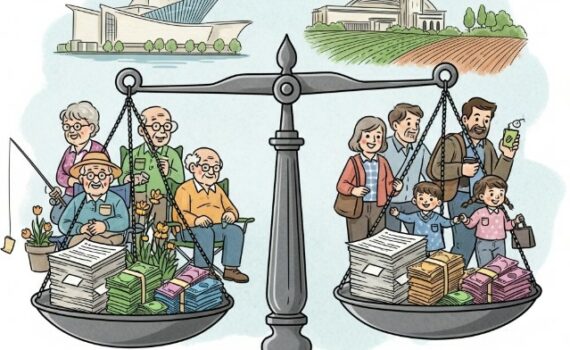

Wisconsin’s Tax Tango: Why Proposed Retirement Breaks Could Burden Working ...

Shifting Sands: A Closer Look at the Badger State’s New Budget and Its Tax Implications Wisconsin’s latest budget, […]

Shifting Sands: A Closer Look at the Badger State’s New Budget and Its Tax Implications Wisconsin’s latest budget, […]

Senator Ted Cruz (R-TX) recently reintroduced the Cost Recovery and Expensing Acceleration to Transform the Economy and Jumpstart […]

The House Ways and Means Committee has introduced its “One Big Beautiful Bill,” a tax package aiming to […]

President Trump’s recurring proposal to replace the federal income tax with tariffs is riddled with practical and economic […]

The Tax Foundation has significantly upgraded its “Taxes and Growth” model, a tool used to analyze the economic, […]

The State Tax Competitiveness Index (STCI), a comprehensive measure of state tax systems, has consistently shown a strong […]

The Internal Revenue Service (IRS) has extended the deadline for third-party payers to use the consolidated claim process […]

The Internal Revenue Service (IRS) has once again delayed the implementation of the $600 reporting threshold for Form […]

The escalating rivalry between the United States and China has ignited a global debate. While geopolitical tensions dominate […]