How to Fill Out IRS Form 656 Offer In Compromise ...

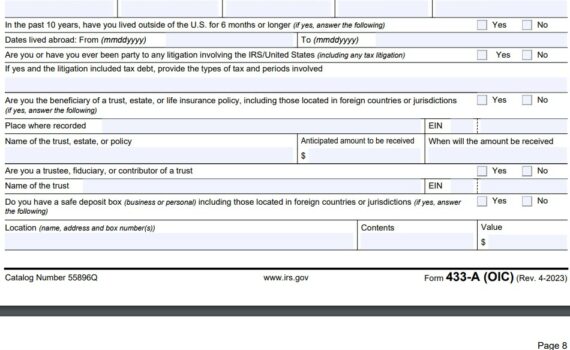

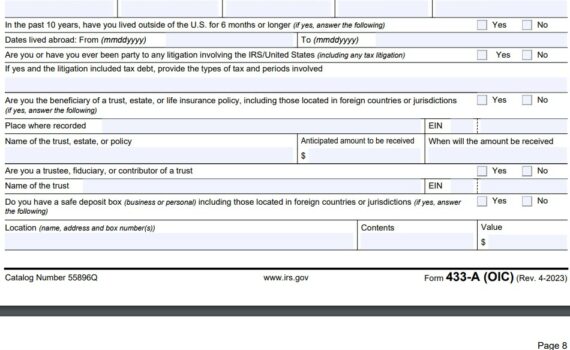

Form 656: Filling It Out This guide will explain how to fill out IRS Form 656 (Booklet|Form), which […]

Form 656: Filling It Out This guide will explain how to fill out IRS Form 656 (Booklet|Form), which […]

We get many calls from people that almost hired Optima Tax Relief, and we find that most people […]

This article covers how to withdraw an IRS lien. If you have active liens and debts that are […]

When a case is in collections with the IRS and you cannot afford any payment (as determined by […]

Easiest Way To Release An IRS Levy On Social Security Benefits The IRS will not take […]

You may have heard about Tax Defense Partners on the radio and have called in to talk to […]

When you are doing tax returns or filing jointly with a deceased person, it can be confusing and […]

Getting An IRS Lien Withdrawal Updated 12/28/2016 to Include Lien Office Information Update 6/9/2021: Credit reporting agencies no longer […]

An Offer In Compromise is a way to settle your debt with the IRS. It is not based […]