Old Unfiled Tax Returns for W2 Employees

Why You Might Not Need To File Old Unfiled IRS Tax Returns When You Only Got a W2 […]

Why You Might Not Need To File Old Unfiled IRS Tax Returns When You Only Got a W2 […]

An Offer in Compromise is an agreement between a taxpayer and the Internal Revenue Service that settles a […]

The IRS can and does set up payment plans, which are an agreement with the IRS to pay […]

Where does the IRS get information to levy your bank account? What info do they use? They use […]

When you owe tax payments to the IRS, there may be alternative avenues to explore. Find out if […]

A CP 2000 is a letter from the IRS notifying you in the case where their figure of […]

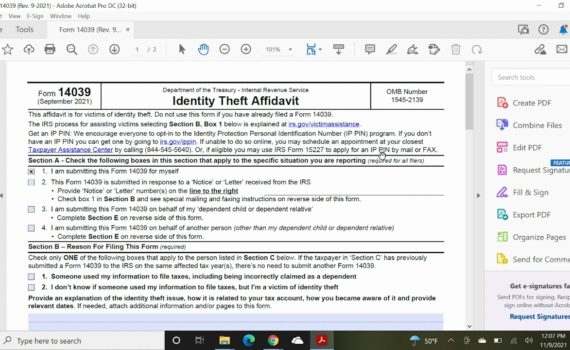

Identity Theft IRS Form - How To File IRS Identity Theft Affidavit Form 14039Watch this video on YouTube […]

The IRS prefers a “pay-as-you-go” system for owed taxes. Rather than have a big payment at the end […]

This advice applies to anyone dealing with tax debt from the state of California’s Franchise Tax Board (FTB). […]