Are Recent State Tax Cuts Financially Feasible?

As state tax revenues taper off from their peak levels, there’s a growing debate over the financial viability […]

As state tax revenues taper off from their peak levels, there’s a growing debate over the financial viability […]

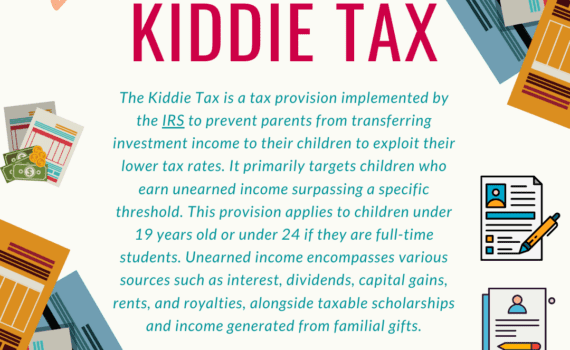

The Internal Revenue Service (IRS) has unveiled extensive proposed regulations, spanning over 280 pages, to enforce congressional directives […]

Understanding the complexities of taxation presents challenges for individuals across the board. Families with children encounter additional nuances […]

Remote work offers numerous benefits, but navigating the tax implications can be daunting. In the past year, a […]

In this article, we will show you how to get old FTB forms. FTB stands for Franchise Tax […]

The long-awaited bipartisan tax deal has successfully passed through the U.S. House of Representatives and is now poised […]

The tax year in the United States spans from January 1st to December 31st annually. Individuals under the […]

If you’ve recently received or are anticipating a bonus, the amount your employer withholds for taxes may surprise […]

Every year, the IRS revises key tax provisions, such as the standard deduction, to ensure that specific elements […]