Elevating Tax Departments: The Power of Technology

Elevating Tax Departments: The Power of Technology Corporate tax departments are under immense pressure. A shrinking talent pool […]

Elevating Tax Departments: The Power of Technology Corporate tax departments are under immense pressure. A shrinking talent pool […]

The recent Republican victory in the U.S. presidential election, with Donald Trump returning to office, signals a major […]

The federal government faces a pressing challenge: how to increase revenue without significantly harming economic growth. This is […]

Every year, the IRS reports that American taxpayers owe over $100 billion in back taxes, penalties, and interest. […]

Whether it’s for convenience, to seek professional help or any other reason one may have, there are those […]

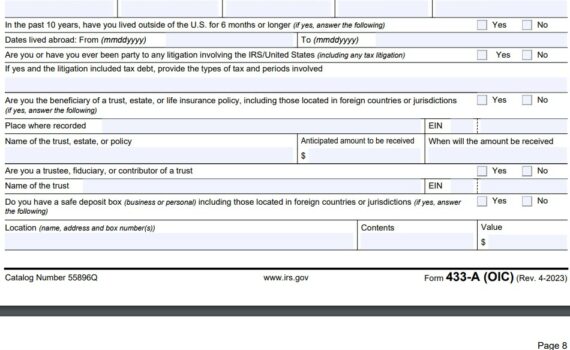

Form 656: Filling It Out This guide will explain how to fill out IRS Form 656 (Booklet|Form), which […]

We get many calls from people that almost hired Optima Tax Relief, and we find that most people […]

This article covers how to withdraw an IRS lien. If you have active liens and debts that are […]

We are always taking a look at our competitors and always surprised how awful some of the companies […]