California FTB Late Filing Penalties

Three types of penalties for FTB late filing: Delinquent Filing Penalty (Individuals and Businesses) Return Late Filing Penalty […]

Three types of penalties for FTB late filing: Delinquent Filing Penalty (Individuals and Businesses) Return Late Filing Penalty […]

Two ways to do it Online (and must meet requirements) Call the Franchise Tax Board Online application You […]

When to use the IRS Taxpayer Advocate Service… Use Part 1: Will you lose or not remain in […]

Some signs your tax debt case was mishandled A lot of time has passed and there is no […]

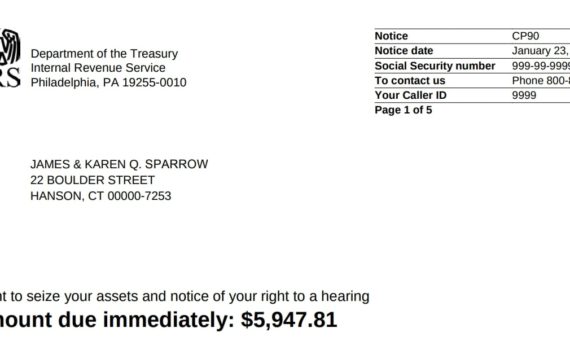

Where does the IRS get information to levy your bank account? What info do they use? They use […]

When you owe tax payments to the IRS, there may be alternative avenues to explore. Find out if […]

IRS Certified Mail Letters – Reasons and Responses Under certain conditions, the IRS will send letters through the […]

Every year, the IRS reports that American taxpayers owe over $100 billion in back taxes, penalties, and interest. […]

Here at Tax Resolution Professionals, we are dedicated to using legal, above-the-board means to help citizens deal with […]