Boost for Main Street: Texas’s Proposed Personal Property Tax Exemption

A Texas ballot measure, Proposition 9, aims to significantly increase the personal property tax exemption for businesses. If […]

A Texas ballot measure, Proposition 9, aims to significantly increase the personal property tax exemption for businesses. If […]

Excise taxes—those specific levies on goods like fuel, alcohol, or tobacco—generate over two trillion dollars annually worldwide. For […]

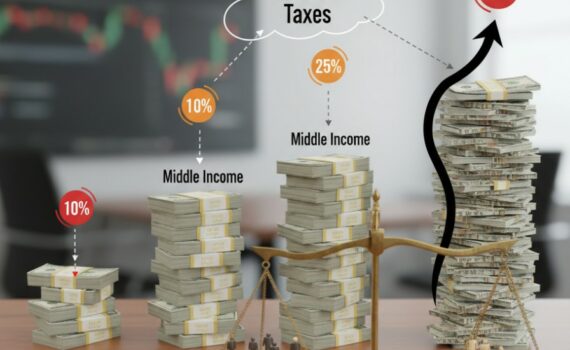

A tax system is progressive when the tax burden on higher-income individuals is proportionally greater than on those […]

Living abroad as a U.S. citizen comes with unique tax challenges, especially when you own or are a […]

In recent years, the international community has been working to change global tax rules for multinational corporations. In […]

President Donald Trump has proposed a new policy that would impose tariffs of up to 250% on imported […]

US businesses and consumers are feeling the pinch from higher costs on goods, largely due to the Trump […]

On August 1st, 2025, a new round of tariffs on U.S. imports is set to take effect for […]

Oklahoma continues its impressive stride towards a more competitive tax environment. Recent legislative action has further refined the […]